montana sales tax rate on vehicles

Rates include state county and city taxes. Determining how much sales tax you need to pay depends on your home states laws and the state in which you bought the car.

What S The Car Sales Tax In Each State Find The Best Car Price

Avoid sales tax and high licensing fees.

. Get the facts before buying or selling a car in Montana. The state of Montana does not impose a general statewide tax at this time. Depending on your states sales tax rate you can legally save 25000 or.

While Montana has no statewide sales tax some municipalities and cities especially large tourist destinations charge their own local sales taxes on most purchases. When it comes to taxes and fees Montana is a mixed bag. Montana local resort areas and communities are authorized.

Additionally registration fees in Montana are normally less than the other states. Car tax as listed. Unfortunately it can take up to 90 days to issue your refund and we may need to ask you to verify your return.

A Montana LLC is considered a Montana resident and like any other resident of Montana wont pay a sales tax on any purchase. If you have a question about a specific circumstance email email protected or call 406-444-3661. However the state does impose a tax on sales of medical marijuana products a sales and use tax on accommodations and campgrounds a lodging facility use tax and a limited sales and use tax on the base rental charge for rental vehicles.

States within the US. The latest sales tax rates for cities in Montana MT state. Alabama 2 Colorado 29 North Carolina 3 Oklahoma 325 Hawaii 4 Louisiana 4 New Mexico 4 New York 4 and South Dakota 4.

If you form a Montana LLC and have it purchase and take title to a motorhome or RV you wont owe any sales tax in Montana. Collected sales taxes in 2014-15 with averages of 23. For example Alaska Delaware Montana New Hampshire and Oregon do not levy sales tax on cars.

775 for vehicle over 50000. These are general guidelines. 10 Montana Highway Patrol Salary and Retention Fee.

Click here for a larger sales tax map or here for a sales tax table. It can only work with LLCs formed in Montana because Montana is the only state which imposes no sales tax on the purchase of vehicles by its residents including resident LLCs. Fees collected at the time of permanent registration are.

Which states have low car sales tax rates. 425 Motor Vehicle Document Fee. By establishing a Montana holding company you can legally avoid paying sales taxes on any purchases you make under that holding company name.

Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Montana local counties cities and special taxation districts. There are 38 states that allow local sales taxes as well as the statewide sales tax. Please note that special sales tax laws max exist for the sale of cars and vehicles services or other types of transaction.

Both are above the 9 percent rate. Montana does not impose a state-wide sales tax. Montana MPG 1497 Miles 14556 Average pricegallon 225 Annual Cost 2189.

Montana Individual Income Tax Resources. Let your Montana LLC buy it. Use tax is paid at the time a vehicle is registered with the Department of Licensing if sales tax was not paid.

Combined with the state sales tax the highest sales tax rate in Montana is NA in the cities of Billings. 2020 rates included for use while preparing your income tax deduction. Tips for Selling a Vehicle in Montana.

Montana Sales Consulting Inc. Learn more about MT vehicle tax obtaining a bill of sale transferring vehicle ownership and more. To legally sell a vehicle you must be the owner listed on the Certificate of Title.

Montana has no state sales tax and allows local governments to collect a local option sales tax of up to NA. Laura Blackman Motor Vehicle Supervisor for Gallatin Valley explains how a loophole in Montana law allows out-of-state residents to avoid paying sales taxes by registering their vehicles in Montana. 635 for vehicle 50k or less.

A small percentage of 5 percent. You dont buy the motor home your LLC does. Montana is one of the five states in the USA that have no state sales tax.

While registering this RV in your home state may cost you as much as 20000 after sales tax and licensing fees with a Montana LLC this same vehicle can be registered for approximately 1500 plus the small annual fee to maintain your LLC in the future. Because there is no sales tax in the state and several counties also do not levy a local option tax the cost of registering luxury vehicles here as opposed to other states that may have registration fees sales tax and local taxes is significantly lower. Select View Sales Rates and Taxes then select city and add percentages for total sales tax rate.

Legally Avoid Paying Sales Tax. The motor vehicle saleslease tax of three-tenths of one percent 03 on motor vehicles also applies when use tax is due on a vehicle. Even vehicles that have previously been registered in other states may benefit from a.

Requirements vary by state you. Legally Selling the Vehicle. As of 2020 New York has a car tax rate of 4 percent plus local taxes whereas next-door neighbor Massachusetts has a state car tax rate of 625 percent with some local rates much higher.

There are a total of 105 local tax jurisdictions across the state collecting an average local tax of NA. Montana is one of only four states that do not have a. Fortunately there are several states with low car sales tax rates at or below 4.

When selling a motor vehicle every situation will be unique. The Department of Revenue works hard to ensure we process everyones return as securely and quickly as possible. Vehicle owners to register their cars in Montana.

As a non-resident of Montana you may be able to avoid paying sales tax personal property tax and high licensing fees upon the purchase of your new high-performance car boat airplane or RV. County tax 9 optional state parks support certain special plate fees and for light trucks the gross vehicle weight GVW fees.

How Is Tax Liability Calculated Common Tax Questions Answered

Car Tax By State Usa Manual Car Sales Tax Calculator

Sales And Use Tax What Is The Difference Between Sales Use Tax

Oc Only 5 States Have No Sales Tax R Dataisbeautiful

Montana Vehicle Registration Cost Rv Recreational Vehicles Rv Financing

Think Twice About Registering Rv In A Montana Llc Rv Tailgate Life Rv Rv For Sale Rv Life

How Is Tax Liability Calculated Common Tax Questions Answered

Sales Taxes In The United States Wikiwand

How Much Does Your State Collect In Sales Taxes Per Capita

What Is The Purpose Of Sales Tax Quora

Sales Taxes In The United States Wikiwand

Sales Taxes In The United States Wikiwand

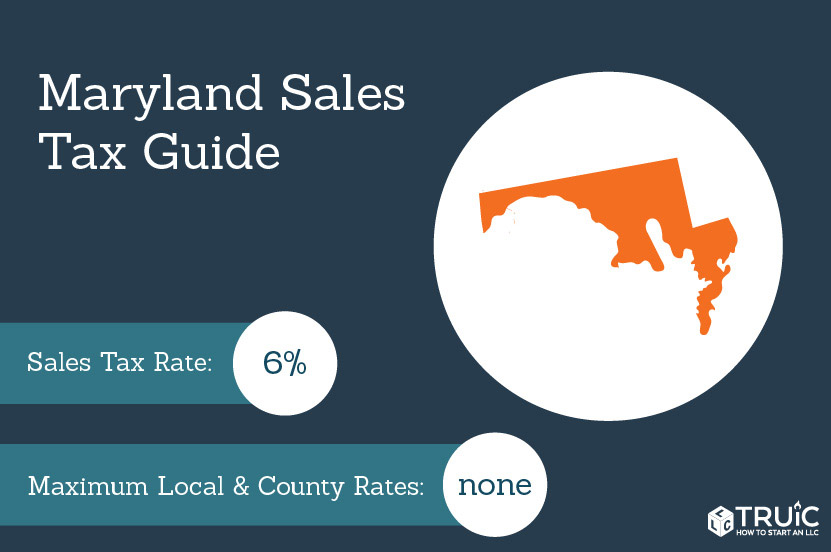

Maryland Sales Tax Small Business Guide Truic

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

Sales Taxes Are Highest In Tennessee Two Cities In Alabama Aug 19 2010

Vintage 1940 Buick Sedan Auto Title Only Historical Document From Michigan Car Title Historical Documents Buick Sedan